Money

How to Withdraw Money from a Credit Card Without a Fee in India 2022? | Know What is a Credit Card Cash Advance Limit, Advantages & Disadvantages, Charges

Can we withdraw money from credit cards? We know, at some point in life, many of you have thought of investing in a credit card but are curious about all the information about it. Relax, we have got that covered for you.

In simple words, a credit card is similar to any bank card that allows the card owner to borrow funds that they can use to buy stuff and pay for them later depending upon the card limit and whether the particular service accepts credit cards or not.

But can you withdraw money from credit cards? Well, yes apart from just swiping your credit card on machines, many credit card companies allow you to withdraw cash in times of emergency, just like any other ATM card in the name of cash advance.

The whole scenario is not that simple, there are a few financial criteria and possible charges that come along with it. In this article, we will help you with all the necessary terms like cash advance, cash limit, financial and interest charges, advantages and disadvantages, how to withdraw credit cash, and all other information related to various situations that you can face while using credit cards.

- What is Credit Card Cash Withdrawal?

- How to Withdraw Cash from a Credit Card in India?

- Comparison Between Credit Card Cash Advance Limit and Credit Limit

- Financial Charges and Other Related Fees on Credit Card Cash Withdrawal

- Does Credit Card Cash Advance withdrawal Impact Credit Score?

- Benefits and Drawbacks of Credit Card Cash Withdrawal

- Can we withdraw money from the HDFC credit card?

- Can we withdraw money from a credit card in ATM?

- How to withdraw cash from a credit card without charges?

- What happens if I fail to repay the cash withdrawn from the credit card?

What is Credit Card Cash Withdrawal?

In case of emergencies, you can withdraw cash from your credit card which is technically referred to as a credit card cash advance. A credit card cash advance allows you to withdraw cash using your credit card from any ATM center near you irrespective of the bank that has issued your credit card.

Some banks may charge an additional fine or set a minimum or maximum credit limit if you are using any other bank’s ATM to withdraw cash from your credit card.

Borrowing cash advance starts generating interest immediately unlike other payment methods where you are given a grace period of 20 to 30 days to pay the bill before charging interest.

Always make sure to first check your card limit and other respective terms and conditions first before withdrawing to prevent yourself from overusing your cash limit.

In such a situation, many banks charge extra fees in the name of an over limit. If you are not able to keep track of the outstanding cash then you might face some potential troubles and may also have to give extra charges tampering with your credit score.

Also Refer: How Credit Card Companies Make Money

How to Withdraw Cash from a Credit Card in India?

Credit card cash withdrawals are like short-term loans that are super easy and quick. There are many ways to borrow cash advance against your credit limit, to name a few you can request a credit card cash transfer from your bank, you can withdraw cash directly from an ATM by inserting your credit card in the machine and putting the correct pin number, or write a convenience check addressing yourself and cash it at a bank.

But keep in mind to repay the amount and the interest generated within the allocated time to avoid credit score and other financial disputes. Go through your credit card statement or call your card issuer bank to know about your cash advance limit to avoid overusing your limit and getting an over the limit fee charged.

Comparison Between Credit Card Cash Advance Limit and Credit Limit

A credit card advance limit is the maximum amount of cash that you can withdraw from your credit card. On the other hand, a credit limit refers to the maximum expenditure that you can do on your credit card. The advance limit offered varies from bank to bank and customer to customer but is generally 20% to 40% of your total credit limit which is intimated to you right when the credit card is issued.

For example, if you have a credit limit of 1,00,000 rupees INR on your card, you can withdraw cash up to a maximum of Rs 20,000 to Rs 40,000 and not more, the remaining amount is for you to make other regular card transactions. The bank has the full authority to decrease or increase your cash advance limit on the basis of various parameters like your repayment behavior, spending pattern, and other credit-specific factors. In case of revision, the Bank will contact you by email or text message.

Related Articles: Credit Card for Students

Financial Charges and Other Related Fees on Credit Card Cash Withdrawal

Like other credit card transactions, cash withdrawal also comes along with financial charges varying from bank to bank, which is applied from the day you withdraw the amount till the time it is paid. Now let’s have a quick conversation about the various fee terminologies that are associated with cash withdrawal from credit cards:

1. Credit card cash advance fee

Credit card cash advance fee is the amount that is charged every time you make a cash withdrawal from your credit card which is typically a percentage of the amount that is withdrawn even if you do multiple withdrawals on the same day.

Certain banks charge 2% to 3% of the amount withdrawn as a minimum amount of Rs 300 to Rs 500 as a cash advance fee. This charge is reflected on your subsequent monthly credit card billing statement. These rates are dynamic and may vary from bank to bank.

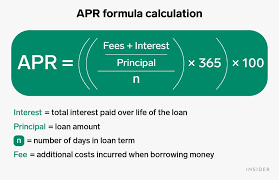

Another most important feature of the cash advance is the APR or Annual Percentage Rate which refers to a yearly interest that is generated depending upon the total amount of money you have withdrawn in that year and is charged to you on an annual basis. Credit card cash advance also attracts additional charges that get levied on the day you repay the amount fully.

Now let us see what are the average cash advance fees of various famous credit card companies:

| Credit Cards | Credit Cash Advance Fees |

| SBI Card Elite | 2.5% for domestic ATMs and 3% for international ones subject to Rs 300 minimum |

| Citi PremierMiles Credit Cards | 2.5% subject to Rs 500 minimum |

| HDFC Regalia Credit card | 2.5% subject to Rs 500 minimum |

| HSBC Visa Platinum credit card | 2.5% subject to Rs 300 minimum |

2. Interest charges

Cash withdrawals from credit cards do not come with an interest-free period like other payment procedures where you are given a grace period of 15 to 30 days after which you will be charged a certain amount. The interest charges levied may vary from bank to bank but is generally a monthly percentage of 2.5 % to 3.5 %. In case you delay repaying the amount, your interest charges will keep increasing.

Here, we have given you a chart that shows the average interest rates levied by different banks:

| Sl no. | Bank | Interest charge rates levied | |

|---|---|---|---|

| Monthly | Annually | ||

| 1. | SBI credit card | up to 3.35 % | up to 40.2% |

| 2. | HDFC credit card | 1.99 % to 3.5% | 23.9% to 42% |

| 3. | Axis Bank credit card | 2.95 % to 3.5 % | 35.4% to 40% |

| 4. | Citibank credit card | 3.1 % to 3.5 % | 37.2 % to 40% |

| 5. | ICICI Bank credit card | 2.49 % to 3.5% | 29.88 % to 42 % |

3. Over the Limit Fees

It is always recommended to first check your credit cash limit before withdrawing cash from your credit card and trying to withdraw money within the set limit. In case you happen to exceed the credit limit for any reason you will be charged with an over the limit fee.

4. Late Payment Fees

As said before, always make sure to repay the withdrawn credit amount within the allotted time. If you delay this you will be charged with an extra late payment fee which generally ranges from 15% to 30% on the outstanding balance.

Does Credit Card Cash Advance withdrawal Impact Credit Score?

A cash advance on withdrawing credit cash doesn’t directly have any impact on your credit score if you do timely credit card bill payments. Only the outstanding amount due on your card is reported to the credit card agencies.

Nonetheless, because of high-interest rate charges on credit cash advances, if you happen to delay in repaying your withdrawn amount and other related financial charges within the stipulated time, then there can be an adverse effect on your credit score.

Hence, as long as you are in the practice of paying bills timely and keeping track of your outstanding balances your credit score remains untampered.

Benefits and Drawbacks of Credit Card Cash Withdrawal

| Advantages | Disadvantages |

|

|

Must Check:

- Pros and Cons of Credit Card Bills through Third-Party Mobile Apps

- List of 10 Best Credit Cards in India | Top Cards from Banks with Reviews

FAQs on How to Withdraw Money from Credit Card without Fee in India 2022?

1. Can we withdraw money from the HDFC credit card?

Yes, you can easily withdraw money from an HDFC credit card by using the credit card on any ATM machine and putting the right pin. You can also write a convenience check to yourself and get it cashed from any nearby bank. HDFC charges a cash advance fee of 2.5% up to Rs 500 minimum, the monthly interest of 1.99 % to 3.5%, and a yearly interest of 24% to 42% for every cash withdrawal transaction.

2. Can we withdraw money from a credit card in ATM?

Yes, most banks allow you to withdraw cash from your credit card in the name of cash advance directly from ATM machines, just by swiping or inserting your credit card and putting the correct pin number. Make sure to check your cash advance limit and other terms and conditions to avoid overusing your limit and getting charged with over the limit fees. Some banks may also charge fees if you are using the ATM of a different bank.

3. How to withdraw cash from a credit card without charges?

You cannot withdraw cash from your credit card without giving financial charges. Right at the moment, you make a cash withdrawal, first, you will be charged with a cash advance fee which is generally 2-3% of the amount withdrawn and an interest rate on a monthly or yearly basis every single time you make a transaction, even if you make multiple transactions on the same day.

4. What happens if I fail to repay the cash withdrawn from the credit card?

In case you fail to repay the withdrawn amount within the stipulated time, you will be charged extra late payment fees, your interest rate will keep increasing and you will have a bad impact on your credit score. Making late payments also prevents you from being eligible for the credit limit or cash limit enhancements. If you continue avoiding payments, your card can get frozen and the debt collector bank may also sue you under legal charges.

Conclusion

Credit card cash advances or withdrawals give you instant money and flexible limits but it is comparatively costlier as compared to other methods of borrowing money. If not very necessary it is not recommended to take cash advances and be subject to the huge financial charges that come along with it.

If you do so, please make sure to read the terms and conditions carefully, know about your credit limit, and make repayment as soon as possible within the allotted time. With this, we have come to the end of our article, hope we could help you in understanding about Can we withdraw money from credit cards, and for more check the other articles that we have uploaded on our official website NewsOzzy.Com.

-

News2 years ago

News2 years agoWhatsApp DP for Students to Free Download | Creative WhatsApp Profile Picture Images that Make you Smile

-

News2 years ago

News2 years agoTop 100 Funny Group Chat Names for WhatsApp & Other Social Media Apps | Best Cute Cool Fun Ideas for Group Names

-

News2 years ago

News2 years agoMorning Assembly Word of the Day List for Students | Best Word of the Day for High School Students

-

News2 years ago

News2 years agoBest Cute Funny Throwback Picture Captions 2022 | Unique Flashback Quotes for Instagram Posts & Stories

-

News3 years ago

News3 years ago100+ Best Captions for Brother’s Handsome Photo That You Can Copy And Paste Easily

-

Instagram2 years ago

Instagram2 years agoTop 200+ Best Cute Cool Instagram Bio Ideas of 2022 That You Can Copy-Paste Easily

-

News2 years ago

News2 years ago100+ Best Cute Sweet Funny Instagram Captions for Sisters Photo | Get Free IG Quotes & Puns for Sisters Selfies

-

News2 years ago

News2 years agoWhat are Some Cool Funny Activities for College Students? | Best Tasks for Party Games